e-Book List

e-Book

For over 30 years, Hong Kong's industrial sector has been described as a declining industry. In the context of global division of labor, as factories moved north, Hong Kong's role as a manufacturing base gradually faded. However, industry is not just about the manufacturing process. Before and after manufacturing, there are many activities involved, such as corporate planning and strategies, research and development of products and technologies, as well as marketing and retail strategies. Hong Kong's industrial sector has only undergone a change in identity and role. While factories have moved north, the headquarters, R&D studios, sales and service department of many companies remain in Hong Kong. In recent years, the form of Hong Kong's industrial sector has evolved beyond the traditional definition of manufacturing. We attempt to extract new knowledge from Hong Kong's industrial cases, and to find the experience and wisdom of innovation and change in business models, planning, organization, scientific research, marketing, and brand strategies, from the experiences of industrialists. We compile their experiences into stories about the continuous growth, change and innovation of Hong Kong's industrial sector. We hope that this book will encourage readers to rethink the significance of Hong Kong's industrial sector, to recognize its capabilities and strengths, and to seize the opportunities brought along by industries in the new era. We also hope to guide Hong Kong manufacturers towards design excellence.

- AuthorPatrick Mok Kin-wai, Jason Wong, Du Ruijie

- PublisherJoint Publishing

- Publication Date2019

- Preview

Since the beginning of the Industrial Revolution in the 18th century, people have generally regarded "industry" as an economic activity that involves processing raw materials into goods in factories, using mechanization and mass production processes to manufacture products. However, the changes in Hong Kong's industry over the years have shown how industrialists and businesses have continuously picked their brains to transform different parts of the production value chain, while struggling to survive, adapting to market changes, renewing and creating new products and services. On the contrary, this volume mainly focuses on some industries that have been traditionally viewed as having lower levels of industrialization while abandoning the concepts of "mechanized production" or "batch mode production". This book re-examine how these industries create new products and services. This includes not only the product design and brand building, as well as the introduction of new machinery and equipment for technical applications, but also the design of business models and strategies, production processes, team composition, and sales models. These industrial design thinking are leading Hong Kong's industry in the 21st century towards design excellence.

- AuthorPatrick Mok Kin-wai, Jason Wong, Du Ruijie

- PublisherJoint Publishing

- Publication Date2020

- Preview

The history of Hong Kong's real estate industry can be traced back to the establishment of the land auction and land rights system and the land lease system in the early days. After World War II, emerging real estate developers represented by Wu Duotai and Henry Fok successively proposed the sales method of "layered sales and installment payments", promoting the transformation of real estate management methods and promoting the initial development of modern real estate industry from both supply and demand perspectives. In the early 1970s, with the rise of Hong Kong's stock market, emerging real estate developers represented by Cheung Kong Holdings, Sun Hung Kai Properties, Hopewell Holdings, and Henderson Land Development successively got listed and fully utilized the functions of the stock market to raise funds to expand their businesses, promoting the rapid development of the real estate industry. By the mid-to-late 1990s, the real estate industry had become an important pillar of Hong Kong's economy and was known as the "barometer of Hong Kong's economy". After 2003, driven by various internal and external, subjective and objective factors, Hong Kong's real estate market began a 16-year cyclical bull market. During this period, the "high land prices", "high property prices", and "high rents" caused by serious imbalance between supply and demand of land and housing had a negative impact on Hong Kong's economic performance and social livelihood. It became a deep-seated factor in many problems in Hong Kong's economy and society. Based on the author's "A Century of Hong Kong Real Estate Industry" published in 2001, this book extends the timeline to 2020, attempting to reveal the entire historical trajectory of the real estate industry from its inception, development to maturity against the macro background of Hong Kong's economic development, transformation and population growth. From this, the basic characteristics and development laws of Hong Kong's real estate industry are discovered, as well as its status, role and influence in the overall economy and people's livelihood. At the same time, the successful business investment strategies and setbacks and failures of major real estate groups are also studied in depth for reference.

- AuthorFeng Bangyan

- PublisherJoint Publishing

- Publication Date2021

- Preview

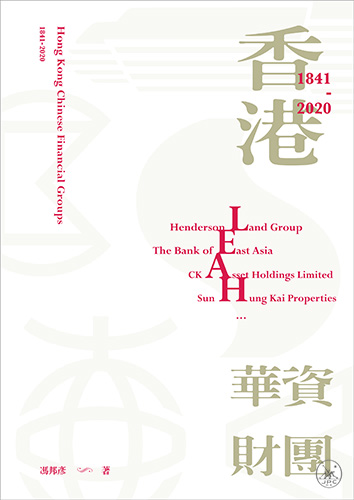

The origin of Hong Kong's Chinese-funded financial groups can be traced back to the development of Chinese compradors represented by Nan Bei Hang and Jin Shan Zhuang and those attached to foreign-funded companies. By the end of the 19th century, with Hong Kong established as a transit port for Far East trade, Chinese-funded financial groups began to emerge in real estate, shipping, retail department stores, and even banking sectors. In the 1960s and 1970s, with the rapid pace of Hong Kong's industrialization, emerging Chinese businesses not only gained dominance in the manufacturing industry, but also gradually gained the upper hand in a series of important industries such as shipping, real estate, hotels, and film and television entertainment. Subsequently, emerging Chinese businessmen represented by Li Ka-shing and Pao Yue-kong successively acquired British-funded companies such as Hutchison Whampoa, Kowloon Wharf, Hong Kong Electric, and Wellcome. Chinese-funded real estate companies such as New World Development, Sun Hung Kai Properties, and Henderson Land Development also transformed into large conglomerates, breaking the long-term monopoly of British-funded financial groups and becoming an important economic force in Hong Kong. After 1997, with the integration and development of Hong Kong and the mainland Chinese economy, Chinese businessmen in Hong Kong came across extensive investment opportunities, especially in the mainland market. In this context, Chinese-funded financial groups that are based in Hong Kong, have broken through geographical restrictions and developed into large enterprises with national, diversified, and even international scopes of businesses. During this period, the Hong Kong Chinese capital consortiums not only became the largest capital force in the Hong Kong economy, but also played an important role in sustaining the prosperity and stability of the Hong Kong’s economy, promoting economic cooperation between Hong Kong and the mainland. The history of Hong Kong’s Chinese-funded consortiums is actually a vivid slice of Hong Kong's modern political and economic history. From it, we can understand the profound changes, development trend and changing laws of Hong Kong over the past 170 years, and be inspired in historical and realistic contexts.

- AuthorFeng Bangyan

- PublisherJoint Publishing

- Publication Date2021

- Preview

Eddie Wang, former CEO of China Minsheng Bank, was the first Hong Kong resident to become CEO of a Mainlandbank. In his book, he shares his personal work experience and candidly discusses the various anecdotes and workplace adventures he encountered during his three years as CEO.

- AuthorEddie Wang

- PublisherThe Commercial Press (Hong Kong) Ltd

- Publication Date2022

- Preview

- Listening Sample

The book first discusses the mining principles, historical background, characteristics, etc. of virtual currencies, and then teaches in detail the process of investing and producing virtual currencies, and analyzes the benefits and risks of participating in investment. Finally, it will also predict the future development trend of virtual currency.

- AuthorQuentin Tsang

- PublisherThe Commercial Press (Hong Kong) Ltd

- Publication Date2022

- Preview

- Listening Sample